We have been involved in the payments business for over 21 years and have been getting cryptocurrency solutions for businesses for the last three years. The largest Cryptocurrency deal took place in Miami when a $22.5 million contract to buy a condo was featured in many articles – Forbes – May 7, 2022.

In Tampa, Florida, a house was sold in an auction; it was sold as an NFT for $654K or about 210 Ethereum – February 11, 2022. Will this be a thing? How do you buy Real Estate with Crypto – the rules about Virtual Currency have been changed by the IRS – resulting in higher taxes if you do not hold the Cryptocurrency for one year – resulting in a hefty capital gains tax.

So, how can you make it happen? What is a taxable event – when there is a transfer from wallet to wallet, both people have a taxable event. Selling your Cryptocurrency – will result in a taxable event – Passing it thru an exchange can result in a taxable event. Who is using Cryptocurrency to buy Real Estate, Crypto Investors, (long-time) International buyers, and Investors?

Nationwide Payment Systems has solved this issue – We have a system that is compliant, and the Cryptocurrency is converted into FIAT – USD $.

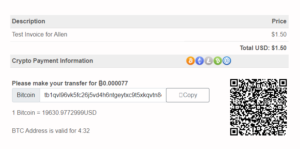

How does it work? A title company, Escrow Agent, or Attorney is set up with our system. A buyer wants to use Crypto – Bitcoin, Litecoin, Eth, USDT (stablecoin) Company sends an invoice by email. The buyer can see how much coin is needed to convert the dollars to crypto and back to crypto

Example – See picture

The invoice for $100,000 – will be converted to crypto – the transaction is good for 15 minutes, and the buyer who is paying can check the coins and switch back and forth once they decide on the coin/token. Then they have 15 minutes to complete the transaction. Scan the QR code with their wallet, and we DO NOT require the buyer to move the Cryptocurrency; we can work with any wallet.

Then the merchant receiving the funds will see in the dashboard that the transaction was accepted ** Wallets, coins/tokens are checked against OFAC List and for any association with stolen Cryptocurrency, etc.

Once accepted, the Cryptocurrency is sold immediately, converted to USD $ (Fiat), and then sent to the Escrow account in case of a Real Estate Transaction within 24-48 hours by bank transfer or Wire. Then the Real Estate Transaction can be completed as the Cash is in the Escrow Account.

Since the escrow agent is not receiving Cryptocurrency, no taxable event occurs during the transaction except for the buyer. Contact us to learn more about our services, compliance, and more. We will see more Real Estate Transactions of all sizes involving Cryptocurrency and Stable Coins.

Nationwide Payment Systems does not give tax or financial advice. We always say talk to your tax professional, or we can refer you to a blockchain/Cryptocurrency Tax specialist. Cryptocurrency and Blockchain will change to adjust to new tax rules, and with Fintech and Open Banking, how people move money and digital/virtual currency will change.

SUBSCRIBE TO OUR NEWSLETTER

Related Articles

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.